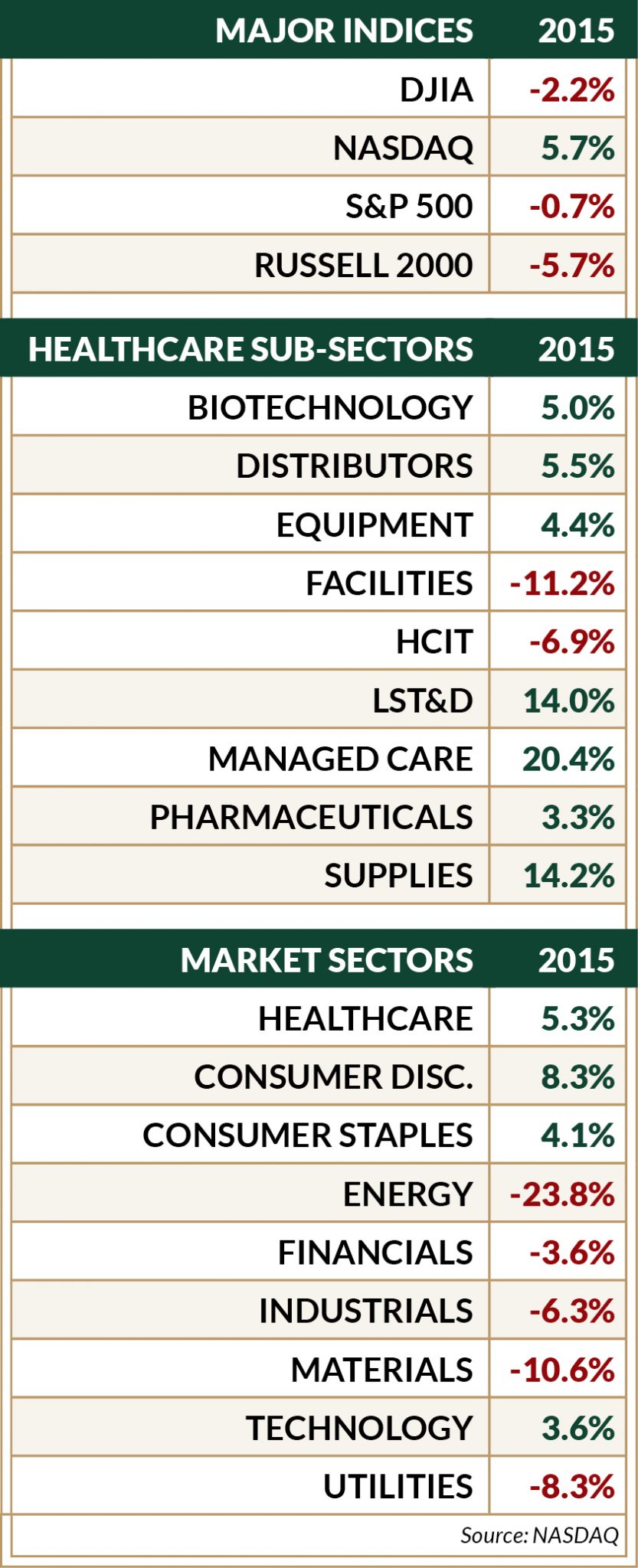

2015 was a volatile year on Wall Street, but healthcare was a source of strength and stability for investors. While most of the major indices declined, healthcare stocks returned 5.3% last year, with several sub-sectors experiencing significant outperformance (see chart below). And 78 healthcare companies went public in 2015, the most of any sector.

This bodes well for another good IPO environment in 2016. To help you prepare for the year to come, we take a look back on the year that was by reflecting on our most widely read blog posts from 2015.

Lessons From the Sell Side: 5 Tips for Talking to Wall Street

By Patti Bank, Managing Director

As an equity analyst, Patti Bank spent 25 years getting paid to poke holes in management teams’ stories about their companies. As she began her new role as a Managing Director with Westwicke last year, she shared some of her secrets from the sell side.

Seven Signs Your Company Isn’t Ready for an IPO

By John Woolford, Managing Director

So you think you’re ready to take your company public? Well, you better be sure you’re right before you start the process, because a withdrawn or unsuccessful IPO can be disastrous. John Woolford offered the seven signs you might not be as ready as you think.

Common Mistakes When Sharing Disappointing News With Wall Street

By Chris Brinzey, Managing Director

In business, bad things happen. It’s inevitable that you’ll have to share disappointing news with your investors sooner or later. The question is whether you’ll mitigate the damage by delivering the news with integrity and transparency, or make the common mistakes that Chris Brinzey outlined.

Looking for an Investment Bank? Don’t Overlook Institutional Sales

By Tom McDonald, Managing Director

When searching for an investment bank, healthcare companies often view the banks’ institutional sales teams as relatively unimportant. Tom McDonald explains why that’s a mistake.

Earnings Calls: Keep it Simple, or Get Creative?

By Leigh Salvo, Principal

Many healthcare companies ask whether there’s a way to make their quarterly earnings calls less, well, boring. And there are ways to present your information more creatively. But Leigh Salvo reminds us to always remember the call’s purpose, which is to inform your investors, not entertain them.

Keep these lessons in mind as you prepare for the year ahead, and peruse the rest of our blog for more insights. If you think there might be an IPO in your company’s future, I urge you to download our new eBook, Westwicke Insider’s Guide to Going Public. And whether you’re still private or already public, feel free to reach out for a conversation about how to broaden your investor base, communicate with your investors more effectively, or develop an effective IR strategy.