There and Back Again: IPO #2

Overview

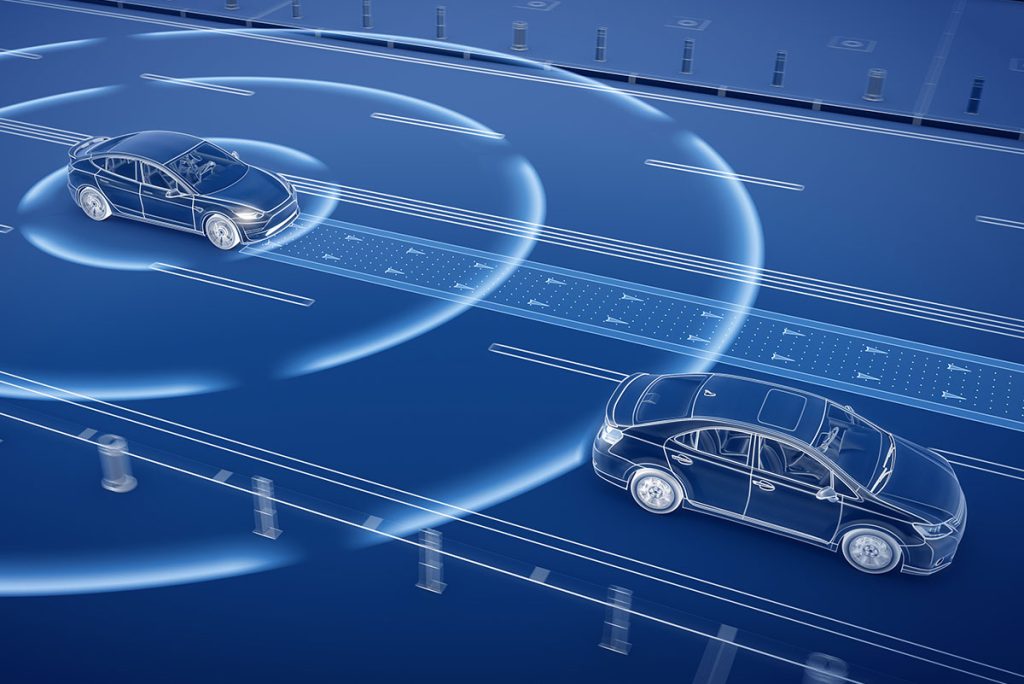

Mobileye, a visionary leader in advanced driver assistance technologies was acquired by Intel in 2027 and engaged ICR in support of going public again in 2022.

The process

Continuing a decade-long relationship

In 2022, when Intel and Mobileye management decided to spin the company off in an IPO, ICR PR/IR was tapped to lead the communications and media engagement process, building on a nearly decade-long relationship of communications advisory.

A second visionary future

Mobileye originally engaged ICR IR before its first IPO in 2014, added ICR PR in 2016 and retained ICR through a $15.3B acquisition by Intel in 2017. The IPO project was complemented foundationally by the well-established, ongoing PR program run by ICR – focused on positioning Mobileye as a bonafide leader and visionary on the future of mobility.

Highlights

NASDAQ:

MBLY

Market Cap:

$10.54 billion

Company Size:

3,600

Headquarters:

Israel

Founded:

1999

Our Solution

A running start

ICR’s domain expertise and experience supporting Mobileye – as well as Intel – essentially provided a “running start” for the IPO program. The team seamlessly led project management, internal/external coordination, media strategy planning and execution, and more, in support of the Mobileye re-entry into the public markets.

An advisor in volatile times

As no IPO is immune to the unexpected, ICR served as a critical advisor through volatile macroeconomic conditions impacting timelines for Mobileye’s IPO – balancing versatility and organization to help teams adjust plans on the fly and get aligned to ensure a successful listing day.

Realizing potential

Even as investors grew skeptical of the broader autonomous driving sector, the ICR team kept its eye on the ball: presenting the IPO as a moment of coronation and asserting Mobileye’s industry leadership and growth potential for financial/investor audiences.