Is ESG dead? ESG has been politicized by both the right and the left of the aisle, and this will continue for the foreseeable future —this is just an uncolored statement of fact. But the anti-ESG sentiment has risen to a fever pitch, from Marc Andreessen’s tirade against ESG which he categorizes under a section in his manifesto called “The Enemy,” to Ron DeSantis signing a bill in May forbidding the use of ESG when investing public money in Florida, just one among dozens of anti-ESG bills flooding Republican-controlled statehouses. Even the SEC left out ESG from its 2024 Examination Priorities, all the while adopting a new rule in September in an attempt to crack down on deceptive use of the term ESG by investment funds.

This anti-ESG/anti-woke momentum has predictably driven pundits to pen laughable “RIP ESG” articles, pointing at BlackRock based on their waning support levels of ESG proposals, claiming that even BlackRock has turned anti-ESG. But such punditry misses a market reality: the ESG bus has left already and will always be a force in how mainstream investors allocate capital now. Full stop. Support levels on ESG shareholder proposals have NOTHING to do with how investors balance portfolios. Institutional investors like BlackRock are members of UN PRI, and these signatories are almost 5,000 in number, which means these investors are required to integrate ESG into their investment and stewardship processes and report their ESG integration progress annually to UN PRI.

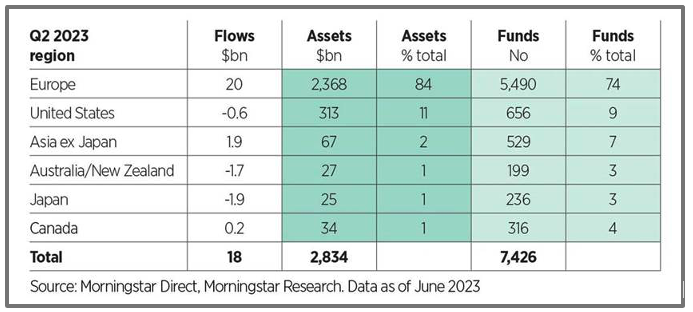

It is true that with the anti-ESG rhetoric, sustainable funds in the US and elsewhere have had outflows (and there have been fewer launches of sustainable funds than previous years). Except for the inconvenient fact that even with the recent trends, the AUM of sustainable assets has actually grown to almost $3T in Q2 2023, which is at near record levels:

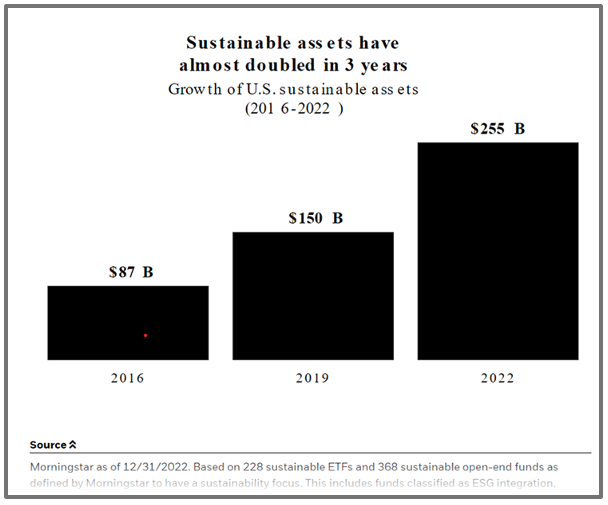

You might say that, well, most of the flows are on the EU side. True, except for another unavoidable fact that US sustainable assets have actually grown rather than contracted over the past years:

And the numbers above only deal with funds explicitly categorized as “sustainable” funds. The real number becomes astronomical when one considers the fact that now, even traditional strategies including many index products, utilize ESG screens. We can only fathom what the real number could be when we consider the collective AUM of thousands of investors who are integrating ESG into their investment decision-making under their UN PRI pledge: US $121.3 trillion as of March 31, 2022.

Here at ICR, we have always advised our clients not to hype their ESG ambitions too much in the ESG boom years, and in these “anti-woke” years, we are telling them don’t subscribe to the anti-ESG rhetoric: both are hypes, if bought into, that will harm our clients’ value creation strategy.

In the end, companies who “do” ESG with intellectual honesty, strongly correlating it to their value creation strategy, will attract the long-only capital. If anything, recent hoopla surrounding the premature and divorced-from-reality pronouncements on the death of ESG only points toward the inadequacy of the term. Call it what you will, but “ESG” will be a force in the markets for the long term.

In the fall/winter season, major institutional investors are embarking on a proactive thematic engagement outreach to their portfolio companies based on ESG issues. For this or other ESG priorities, ICR ESG experts can guide you through clear and tangible next steps past the fraught regulatory and political landscape. Get in touch.