While the successful completion of a SPAC transaction may be cause for a brief celebration, management teams of these now public companies will quickly realize there is little time to sit back and enjoy the milestone. Having completed the rigorous PIPE process, made it through the de-SPAC sprint, secured shareholder approval for the transaction and started trading as a new public company, SPACs face a host of new challenges that come with being a public company. In addition to adapting to rigor of quarterly reporting, management teams need to be prepared for a range of new scenarios that accompany life in the public markets — including activist short attacks. Despite the investor support received throughout the SPAC process, there will invariably be some investors waiting to bet against companies that went public through a SPAC merger.

Why Should SPACs Be Concerned About Short Attacks?

Short attacks against SPACs are on the rise. Since January 1, 2020 through April 26, 2021, 93 SPACs have closed. Of those 93 that have closed, 13 were the victim of short attacks. If you are a recently closed SPAC, there is roughly a 14% chance you will be the target of a short attack.1 For reference, over the same time period, only 2% of traditional IPOs were the target of short attacks.

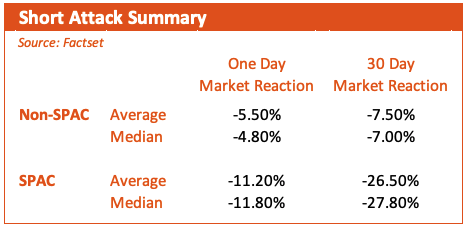

What’s worse: Short attacks against recently de-SPACed companies are highly effective. In fact, short attacks on de-SPAC companies are significantly more effective than non-SPAC public companies. On average, the one-day and 30-day market reactions for short attacks on SPACs are -5.7 ppts and -19.0 ppts worse than non-SPAC companies, respectively.

Given that many recently de-SPAC companies are not yet profitable, short attacks will generally target potential revenue drivers. For example, does the technology actually work? Is the customer pipeline real? Is the valuation inflated due to wild speculation?

SPACs need to prepare answers to all of these questions and more — quickly. On average, SPACs are targeted by short attacks 84 days after the SPAC closes. Almost all short attacks occur within five months of the SPAC close.

How Should Recent SPACs Address a Short Attack?

Short attacks come without warning and often produce headline grabbing criticisms. Companies that recently completed a SPAC merger need to be able to react quickly before the short attack can gain momentum. An effective response strategy includes:

- Isolating the core issues and claims of the short thesis: The short report will often have pages and pages of innuendo and accusations, so the first step is to identify the core of the thesis.

- Gathering the facts to rebut the claims: Once you identify core issues, use the facts to address any misperceptions or fabrications. This is not meant to be a point-by-point rebuttal, as the talking points should focus on addressing the core issues.

- Communicating with all stakeholders: While a short attack is focused on the stock price, all stakeholders will have questions and concerns, so there should be an integrated communications response that reaches shareholders, employees, customers, and other key partners. In certain situations, a press release may be the best way to reach all stakeholders.

- Engaging with top shareholders and analysts: The short attack will impact all shareholders, but in the interest of time, ensure that covering analysts understand any issues with the short’s thesis.

- Researching and understanding your adversary to anticipate potential next moves: Not every short activist is the same and not every campaign is the same, but it is important to understand how the activist has behaved in the past in order to anticipate and prepare for potential follow-on attacks.

- Start getting back on your front foot to tell your story: The short activist has the first-mover advantage, and while the attack may have the company on its heels initially, it is important to find opportunities to regain control of the narrative and get back to telling your story.

The de-SPAC process is rigorous and time consuming. Recent SPACs cannot get comfortable once they have completed the process. With so many SPACs falling victim to short attacks, it is critical to prepare for and anticipate threats from those betting against their success.

To learn more about how to develop and execute a communications strategy for SPACs, download our eBook, “How to Run a Successful SPAC Communications Program.”

ICR Special Situations Team

ICR is the largest advisor and communications consultant to SPACs, having worked on more than 120 transactions over the past decade. If you need help designing and executing a communications program that can guard against short attacks, contact the ICR Special Situations Team:

Phil Denning, Partner

phil.denning@icrinc.com

(646) 277-1258

Dan McDermott, Senior Vice President

dan.mcdermott@icrinc.com

(646) 677-1811

1 Source: Insightia