SEC Advances First-Ever Requirement

The SEC is moving forward with proposed rules that would for the first time require companies to disclose how their operations affect the climate. Three of the four SEC Commissioners voted in support of the proposal for enhanced climate disclosures in public company filings. The public has 60-days to comment on the proposal, after which the Commission will hold a second vote to adopt the rules, effective December 2022.

When adopted, issuers will need to disclose certain climate-related information in regulatory filings such as on Form 10-K, including:

- Actual or likely material impacts of climate-related risks on the business, strategy and outlook

- Governance of climate-related risks and risk management processes

- Greenhouse gas (“GHG”) emissions (for accelerated and large accelerated filers, certain emissions to be subject to assurance)

- Certain climate-related financial statement metrics and related disclosures in a note to audited financial statements

- Information about climate-related targets and goals, and transition plan, if any

Background and Context

Climate change has become the principal industry-agnostic issue over the last decade in which every company has a role to play. Increasingly, climate-related impacts have been well documented and their risks to businesses, capital markets and the overall economy have grown ever more prevalent. According to SEC Chair Gary Gensler more than 90% of the largest companies within the Russell 1000 Index already provide climate and sustainability disclosures. However, the disclosures are often inconsistent, lack the appropriate amount of investment decisions and are located outside of required filings. As a result, investors are seeking more reliable information, and subsequent accounting metrics with attestation, to drive transparency into the material climate risks of a public company’s financial performance. March 22, 2022

First, some context. The SEC first provided guidance on climate-related disclosures to public companies in 2010 and have since enhanced and developed their oversight and counsel. In March 2021, the SEC announced the creation of a Climate and ESG Task Force in the Division of Enforcement with the mandate to develop initiatives in order to clamp-down on climate change and ESG-related malpractice as well as ways to screen for potential misconduct. Now the SEC is proposing amendments within public reporting in order to standardize the process of climate-related disclosures for registrants even further. These proposals complement existing SEC narratives and guidance and have been further influenced by almost 6,000 comments during the public Request for Input, by market-driven solutions by the Task Force on Climate-Related Financial Disclosures (TCFD), and from investor demands, among others.

Below, we will detail exactly what the SEC voted to advance, what the proposed rules mean, and how they affect corporate issuers.

SEC’s Proposed Climate Rules

On March 21, 2022, the SEC’s Commissioners voted on the following climate-related rule amendments to regulation S-K and S-X within annual reports, among others, for domestic or foreign registrants, including:

- Mandatory Scope 1 and Scope 2 greenhouse gas (“GHG”) emissions metrics, and associated intensity by economic value or production;

- A phase-in period for Scope 3 emissions (with an exemption for smaller reporting companies) if proven material or if a goal or target has been proposed as well as including a safe harbor for liability;

- Incorporation of TCFD as the recommended framework for disclosing climate-related governance, business model and strategy, risk management over the short-, medium- or long-term and metrics and targets;

- Description of a transition plan, if one has been adopted, including metrics and targets used to identify and manage any physical and transition risks;

- Impacts from climate-related events (i.e. severe weather, other natural conditions) and transition activities on the line items within consolidated financial statements as well as financial estimates and assumptions; and

- Climate-related targets or goals, including scope of activities and emissions, a defined time horizon, interim targets, progress and updates each fiscal year.

The outcomes of these enhanced reporting disclosures are expected to provide:

- Consistency and comparability for investors to:

- Better allocate risk (reducing costs due to externality);

- Ensure economic wellbeing that can be impacted by climate- and weather damage;

- Reliability of information, including:

- Insight into a company’s internal controls (operations such as GHGs);

- Third-party verification and regulation of auditing;

- Reasonable insurance of Scope 1 – 2 emissions (with more clarity over Scope 3 over time);

- Transparency on company preparedness for disasters and impacts from the financial markets, including both physical and financial risks; and

- Efficient pricing, capital allocation and better cost management for public companies (e.g. measuring emissions, reporting costs, etc.).

Impacts on corporate issuers:

- Annual inventory and reporting of Scope 1 and 2 emissions as well as Scope 3 emissions where applicable, along with methodologies and assumptions;

- Attestation of GHG emissions by an expert GHG provider;

- Articulation of climate-risks related to financial statement metrics;

- Incorporation of identified risks into enterprise risk management; and

- Discussion of climate-related targets and goals, if already defined, and subsequent transition plan.

“Proactively addressing emerging disclosure gaps that threaten investors and the market has always been core to the SEC’s mission,” said Acting Deputy Director of Enforcement Kelly L. Gibson. Gensler, as well as Commissioners Allison Herren Lee and Caroline Crenshaw, also believe the amendments satisfy the Agency’s duty to step in when there is a demand for and need to develop more fair and clear financial performance of public companies, including climate-related risks. Commissioner Hester Peirce – the only Republican on the panel – voted against the proposal, stating the plan is outside the commission’s statutory limits.

Takeaways

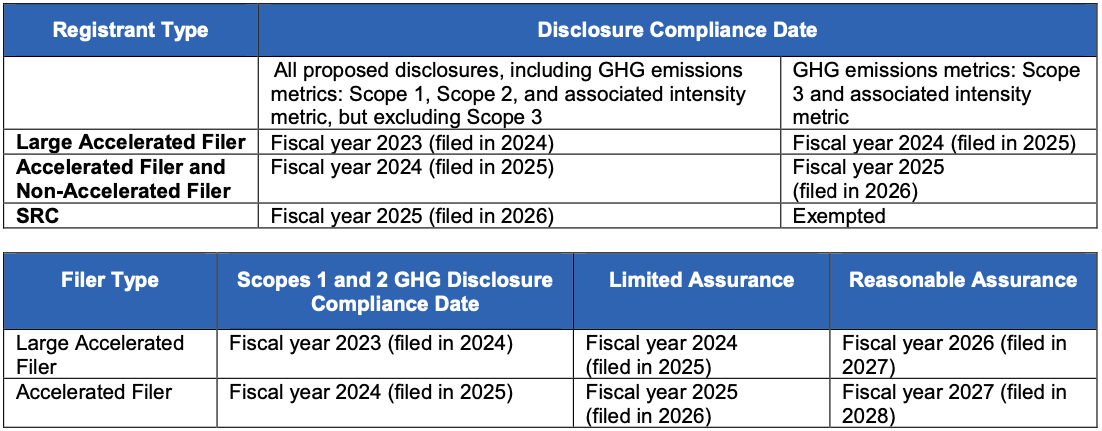

When adopted as rule in December 2022, the table below describes disclosure compliance timetable for public companies:

We advise all companies, especially those who have not yet set their ESG and climate-related strategies, to take the following immediate steps:

- Conduct a full ESG diagnostic process leveraging TCFD, SASB and/or other relevant frameworks to both take inventory of ESG information and identify gaps

- Create an ESG report which aligns with both investor and regulatory expectations on ESG and climate disclosures

- Formulate a strategy to disclose climate-related information in the 2023 annual reports and/or proxy materials to be in compliance with the SEC’s expected ruling

Questions or comments? Email our ESG Team at esg@icrinc.com.