Over the course of the quarter, ICR Capital advised on numerous IPOs, Follow-ons, and Convertibles raising gross proceeds in excess of $5 billion.

IPOs

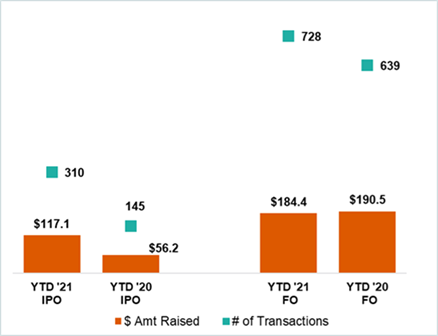

- Last week closed the books on Q3 which saw 82 IPOs raise $29.8bn and capped off a record 5 consecutive quarters of >$25bn in IPO supply

- The only period that comes close to this volume was Q4 1999 to Q2 2000 which saw 3 quarters of >$25bn IPO supply

- For reference, over the last 10 years average quarterly IPO supply has been $12bn

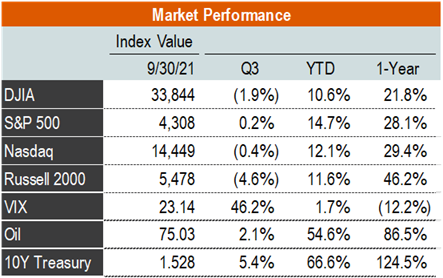

- Despite some choppiness in the broader market (the VIX closed Q3 at 23%, up 7.3 percentage points over the quarter), the IPO market was relatively resilient

- 83% of Q3 IPOs priced above or within the range and 72% are trading above issue

- That said performance has been bifurcated – those that are trading below issue are off (20%) on average and those that are above issue are up an average of +32%

- Taking a longer-term view, YTD IPO performance has been more muted and just 51% are trading above issue

- On average 2021 IPOs are up 6.9%, lagging the YTD 14.7% return on the S&P 500

Follow-ons

- Q3 follow-on activity was also robust with over $55bn in supply across 142 offerings, bringing total YTD supply to $180bn

- For comparison, this is well in excess of the <$150bn in full year supply in 2017-2019 but still below the $250bn priced in 2020

- On the back of strong valuations and investor demand, sponsors have been able to accelerate their path to monetization in portfolio companies this year. Roughly half of YTD first follow-ons priced within 180 days of their IPO (for many (not all) IPOs 180 days is the standard lock-up period post IPO)

- ICR Capital advised, Leslie’s, Inc., has priced 3 follow-ons in 2021, raising $1.98bn. Inclusive of the October 2020 IPO, the company has raised ~$2.6bn in proceeds. As a result, selling shareholders, L Catterton and GIC have taken their stake from ~86% pre-IPO to ~27% within 1 year

- KKR owned, Academy Sports & Outdoors took a similar path with 3 follow-ons in 2021 raising $1.65bn. KKR’s monetization was completed after the $834mm follow-on in September, which included a $200mm concurrent repurchase of shares by the company. Academy Sports & Outdoors used a similar strategy in their $515mm May follow-on as well, where they concurrently repurchased $100mm in shares

Convertibles

- The convertible market saw 23 companies raise $15.0bn

- While issuance levels were slower vs. Q1 and Q2, the market is stronger vs. the lackluster early summer as investors are again aggressively bidding for paper due to slow issuance

- 55% of the convertible bond issuers in Q3 achieved a coupon of 0.5% or lower and 41% issued a conversion premium of 40% or higher

- Market in Q4 is likely to be busy as issuers take advantage of the market strength and raise capital before year end

For more information, please contact the ICR Capital Team:

- Steve Parish, Co-Head ICR Capital, steve.parish@icrcapital.com

- Patrick Hanraty, Managing Director, patrick.hanraty@icrcapital.com

- Niren Nazareth, Managing Director, niren.nazareth@icrcapital.com

- Ashu Vats, Senior Vice President, ashu.vats@icrcapital.com

- Lee Stettner, Co-Head ICR Capital, lee.stettner@icrcapital.com

- Lindsay Hyde, Managing Director, lindsay.hyde@icrcapital.com

- Terry Quinn, Managing Director, terry.quinn@icrcapital.com

- Jeff Bernstein, Head of Technology Capital Markets, jeff.bernstein@icrcapital.com

- Raj Imteaz, Head of Convertible and Equity Derivatives Advisory, Syed.Imteaz@icrcapital.com

- Anna Shearer, Managing Director, anna.shearer@icrcapital.com

- Marisa Frackman, Managing Director, marisa.frackman@icrcapital.com

- Sameer Khambadkone, Managing Director, sameer.khambadkone@icrcapital.com

- Melissa Calandruccio, Senior Vice President, melissa.calandruccio@icrcapital.com