Some people are a little surprised to hear that a decent percentage of our clients at Westwicke are private, venture-backed healthcare companies. “Why,” they ask, “do private companies need investor relations?”

Having spent the majority of my professional career on the buy side at one of the first U.S.-based healthcare crossover firms, I typically respond by saying: “I often wonder why it takes private companies so long before they do reach out to the buy side!”

While there is certainly a lot that needs to be done before it makes sense for a private company to begin the process of meeting institutional buy-side investors — pressure testing the corporate strategy and corporate message, formulating ideas about exit routes and timing, etc. — there really are a lot of good reasons to consider getting started sooner rather than later.

Here are a few common questions we get from companies when we explain the pros and cons of meeting institutional investors early.

When is it too early to start the process of meeting institutional investors?

A better question, I believe, is “When is it too late?” The quick answer is that it’s probably too late when your IPO road show marks your first meeting with potential buyers.

I can recall numerous occasions when my buy-side colleagues and I sat across the table from really great companies telling truly compelling stories. But that wasn’t enough. Our portfolio manager would explain that we couldn’t make the investment. There just wasn’t enough time to complete diligence. Nor was there enough history between their organization and ours.

While it’s true that some investors will buy IPOs despite a short time frame and the absence of an established relationship, particularly for deals that are considered “hot,” many of the ideal, long-term holders will not. These firms can have strict investment processes, requiring thorough vetting, formal write-ups and the completion of other procedures that take time. In these instances, even if the investor loves what they hear during your road show presentation, they likely won’t buy your stock. We often suggest, when possible, to start the relationship-building process six to 12 months ahead of an expected IPO road show.

What’s the benefit of meeting investors while I’m private?

It’s hard to emphasize enough the importance of building relationships with institutional investors early and often so that you begin to establish a track record. I explained the process many institutional investors require to make an investment in companies where that track record doesn’t exist; let’s now turn to the opposite situation.

There were companies that I covered long enough to understand the fundamentals and trust the management team’s ability to hit milestones and execute their plan. In these cases, I didn’t need to conduct thorough diligence every time I thought we should buy the stock. The process changed from requiring a thorough write-up and investment meeting to a quick, informal meeting with the portfolio manager followed by agreement (or disagreement) on buying the stock. This is the situation you want to find yourself in as a private company. Whether you decide to remain private or go public, you now have the well-established relationship and track record with the investors that can participate in the IPO or, in some cases, your next private of round financing.

Why bother meeting institutional investors if I’m not sure what my exit plan is?

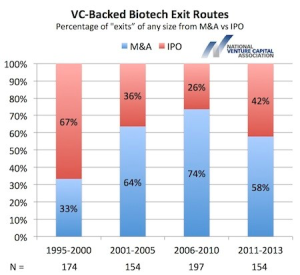

This is a very fair question, and I can appreciate that it is difficult to know whether the best exit route is a public offering, a merger, or an acquisition. In fact, as the chart to the left from the National Venture Capital Association illustrates, the way a company exits very much depends upon the state of the markets or the result of a dynamic decision process that is made opportunistically.

This is a very fair question, and I can appreciate that it is difficult to know whether the best exit route is a public offering, a merger, or an acquisition. In fact, as the chart to the left from the National Venture Capital Association illustrates, the way a company exits very much depends upon the state of the markets or the result of a dynamic decision process that is made opportunistically.

Because of this, we suggest that companies should always err on the side of being more prepared than underprepared. The gains made meeting institutional accounts early are significant and should not be overlooked. We talked about the importance of building the relationship, but the advantages don’t stop there.

In these meetings, you will be getting time with some of the savviest investors around and the feedback you receive can be invaluable. Their input may range from the good to the bad, but in either case it is key data that can help in refining key messages/positioning, ensuring the development of proper metrics, and understanding the types of questions and issues that investors have with the story. All of this, when used, can significantly enhance your company’s long-term value.

If the time is right for your company to start forging relationships with investors, you may want to consider establishing a partnership with an advisor. To get a better understanding of what it’s like to work with an IR expert, please read this recent post. And if you’d like to have a one-on-one, don’t hesitate to contact us.