The SPAC market had its best quarter since 2022, with serial sponsors driving the bulk of deal pricing and numerous additional filers expected. SPAC mergers are re-emerging as a pathway to the public markets, particularly for those companies that may not be ideal IPO candidates.

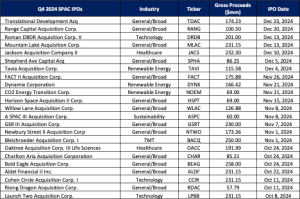

In the fourth quarter of 2024, the SPAC IPO market saw the pricing of 23 IPOs, raising a total of $3.8 billion—the highest quarterly proceeds in the last two years. Approximately 70% of the new SPAC IPOs this quarter were serial SPAC issuers raising $2.8 billion. This surge in proceeds is attributed to an increase in the number of IPOs coupled with higher average deal sizes for serial sponsors, which reached $177 million this quarter.

“As we move into 2025, SPAC mergers are once again emerging as a viable pathway to the public markets, particularly for companies outside the traditional IPO mold,” said Don Duffy, President of ICR. “With the IPO market leaning toward larger issuers, SPACs are uniquely positioned to source deals from an extensive backlog or partner with smaller, growth-oriented companies seeking public market access. Additionally, the serial sponsor activity signals optimism for deal flow, supported by private equity and venture capital firms that will be looking for alternative liquidity options.”

“SPAC mergers still require financing packages that satisfy the capital requirements of the post-merger company,” said Niren Nazareth, Managing Director at ICR Capital. “Redemptions generally remained high in 4Q ‘24, and so structured financing solutions will likely continue as a critical component to bridge potential funding gaps and de-risk transactions.”

ICR is the largest communications consultant and advisor to SPACs, having worked on over 170 transactions since 2021. Download a copy of ICR’s Yearend 2024 SPAC Market Update & Outlook report today.