Yogi Berra, the late New York Yankees great and linguistic humorist once said, “It’s tough to make predictions, especially about the future.” Yes, it is. Because how many authors of 2023 year-ahead outlooks saw the run on Silicon Valley Bank, the AI boom, and the Israel-Hamas war coming? 2024 will certainly bring its own share of surprises. But there is a great deal we do know that will matter next year. Here are seven news themes that will not be a surprise but are sure to be ones the media will care about.

The global economy

The macro-economic picture remains one of the chief uncertainties for business and policy makers. Global economies have been a patchwork of growth and inflation (in some cases de-flation). The U.S. is poised to grow but at a muted 1.5 percent according to the IMF, down from 2.1 percent this year. Consumer spending had been keeping the economy afloat, but the data are starting to show a slowdown. Investors and economists are even warning of a recession early next year.

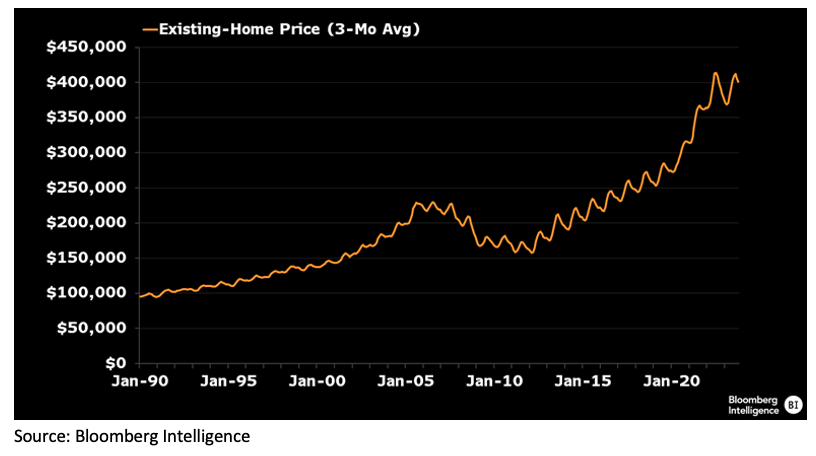

One of the big speedbumps to contend with is the residential housing market. Decades-high mortgage rates and high home prices (chart below) are keeping potential buyers out of the market and current homeowners right where they are. This has both short- and long-term implications for the housing market. Even if mortgage rates or home prices come down a bit, that could bring buyers flooding back in, pushing prices right back up.

Watching all the while are Jerome Powell and the Federal Reserve, who have telegraphed “higher-for-longer” interest rates. Traders are expecting the central bank will keep rates steady with rate cuts possible as soon as the Spring. Higher rates mean a higher cost of borrowing and doing business.

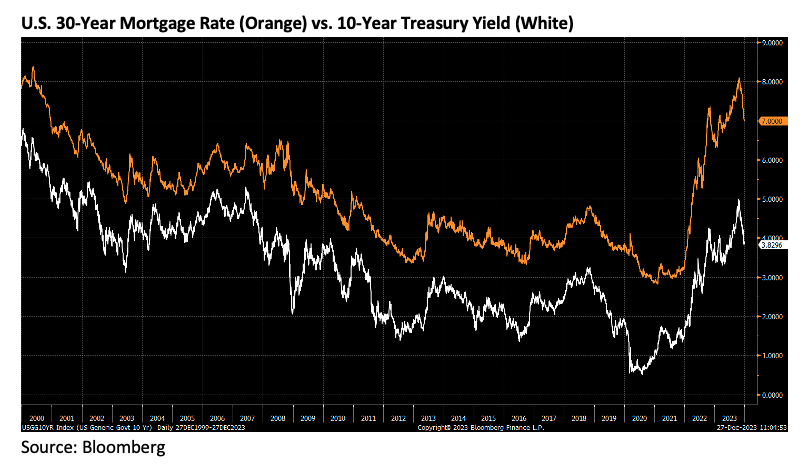

State of the markets

It’s the ultimate chicken and egg scenario. Markets reflect the confidence – or lack thereof – of investors, businesses, and Main Street. But their confidence also hinges on the performance of those markets. Which comes first? Right now, equities are winning the positive feedback loop contest. The S&P 500 is up about 19 percent year to date after a similar sized loss last year. But rates will continue to be the focus given their effect up and down the business food chain. As the Fed keeps rates elevated, Treasury yields and mortgage rates (chart below) will remain higher as well, though it appears both recently hit a short-term ceiling. Still, higher rates are a higher cost of doing business.

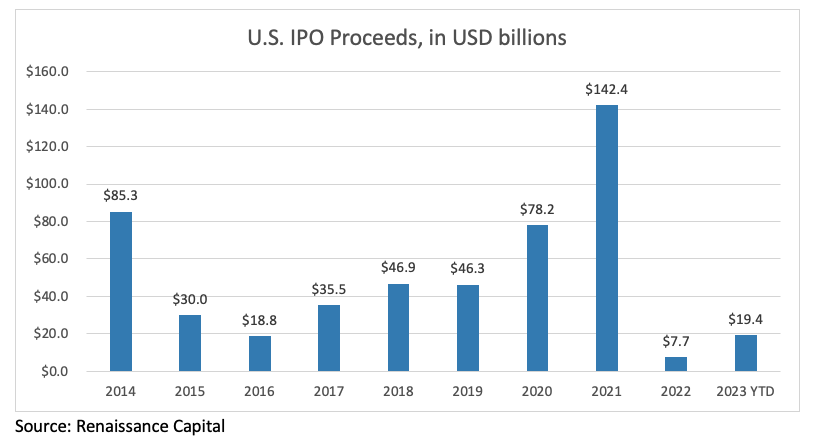

Market-watchers will also have a close eye on IPOs. We got a flurry of activity in the Fall with the IPOs of Arm, Instacart, Birkenstock and Klaviyo. Investors were holding their collective breath that these issues would show IPOs are back. But the latter three of those stocks are stuck below their offer price, despite a resilient stock market. Bankers large and small expect a revival in IPOs and deal-making in 2024, especially if the Fed cuts rates. One cut is all it will take for the doors to open, according to ICR’s IPO gurus.

Elections/Balance of power

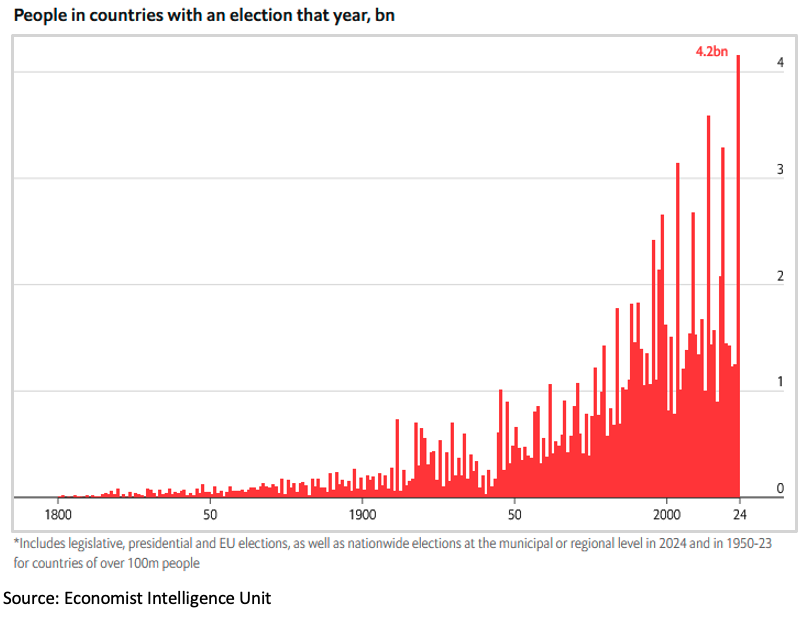

The single biggest general news theme of the year will be the U.S. elections in November. Putting aside the social divisions and political theater that will go along with a potential Joe Biden-Donald Trump matchup, there is a great deal at stake for the economy and for business. A Republican White House and Congress will no doubt seek to reverse the Biden administration’s regulatory actions and proposals which affect the markets, deal-making and the environment, to name a few areas. Regardless of who controls the balance of power, economic and fiscal policies will most certainly shift. That will make righting the economy and avoiding a recession more of a moving target for the Fed. A divided government will mean more years of gridlock, partisan fighting and congressional investigations.

And it’s not just elections in the U.S. The Economist is calling 2024 “the biggest election year in history.” Seventy-six countries are holding elections next year. Eight of the ten most populous countries are among them, and half of those are considered “flawed democracies,” according to the Economist Intelligence Unit. Yes, the U.S. is one of them.

Geopolitics: U.S.-China, Russia-Ukraine, and Mideast Tension

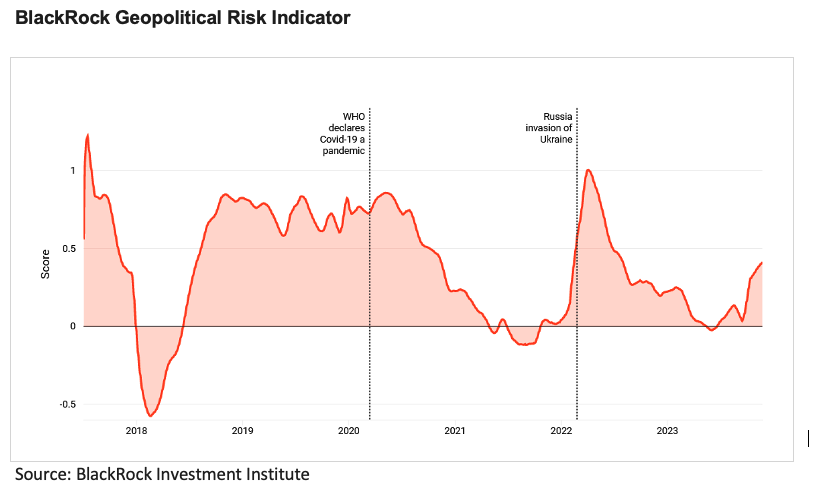

Geopolitical hotspots abound as we head into 2024. News outlets have prioritized the war between Israel and Hamas given the region’s strategic importance, the proxies for global powers that each side serves, and the social and political ripple effects, particularly in the U.S. The Ukraine-Russia war does not command front page news as it once did, but that does not diminish the importance of this and other conflicts. U.S.-China relations remain strained and other risks like North Korea simmer on the back-burner. While the economic impact of Ukraine-Russia has been baked in for some time, there has been minimal economic or market impact from the events in the Middle East. When geopolitical risks rise to the level of moving markets or altering economic growth, that’s when coverage will increase and businesses and politicians will start to care.

Artificial Intelligence 2.0 and Digital Transformation

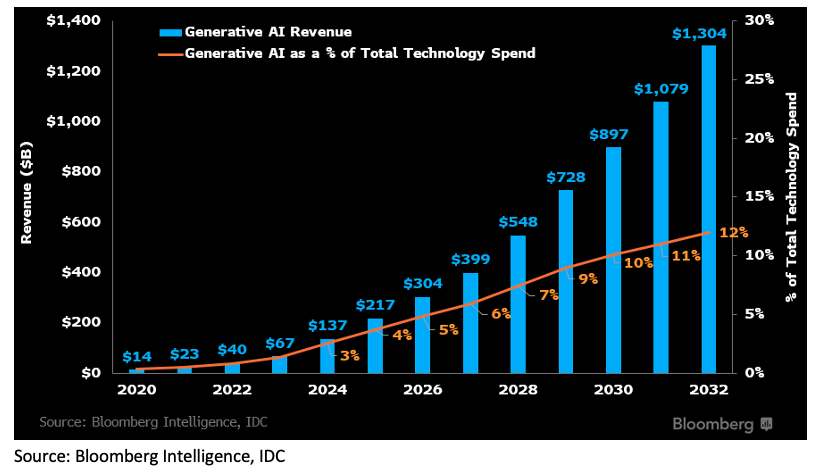

You need only look to the recent drama around OpenAI leadership to see how important the artificial intelligence story is to the business community and the news cycle. OpenAI became a leader in the space when it launched its generative-AI chatbot ChatGPT a year ago. Since then, it has been a horse race to release new chatbots and AI-based products for businesses. A recent report from IDC clocked GenAI business spending at nearly $16 billion in 2023 after less than a billion in 2022; and it’s expected to grow to $143 billion by 2027. A separate report by Bloomberg Intelligence (chart below) found revenue from GenAI will climb to $1.3 trillion by 2032. Needless to say, media will be all over the players, advancements and money behind AI next year and the years to come.

EVs and the Energy Transition

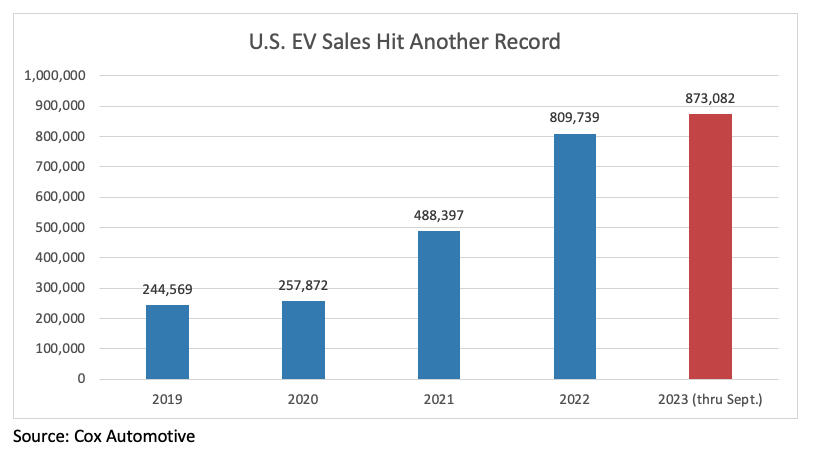

The nation’s transition to electric vehicles got a reality check this year. President Biden’s push to have 50 percent of all new vehicle sales be electric by 2030 is running into all sorts of speed bumps. The carmakers have struggled to keep EV costs down and are now pulling back on investment and production. Unionized workers, who went on strike for six weeks this fall, demanded and won protections as carmakers deal with the rising expense. EV sales in the U.S. will hit another record this year. In fact, they surpassed last year’s total in the first 9 months of the year (chart below). Still, the pace of purchases has slowed in recent months. The fragmented electric grid is also struggling to meet this new demand. How the administration, auto industry and consumers take the next steps will be crucial in the adoption of a new energy future.

And that’s just automobiles. How the nation produces and consumes energy in a period of rising climate temperatures and pollution will be key in the success and/or failure of different energy modes and businesses in the energy sector.

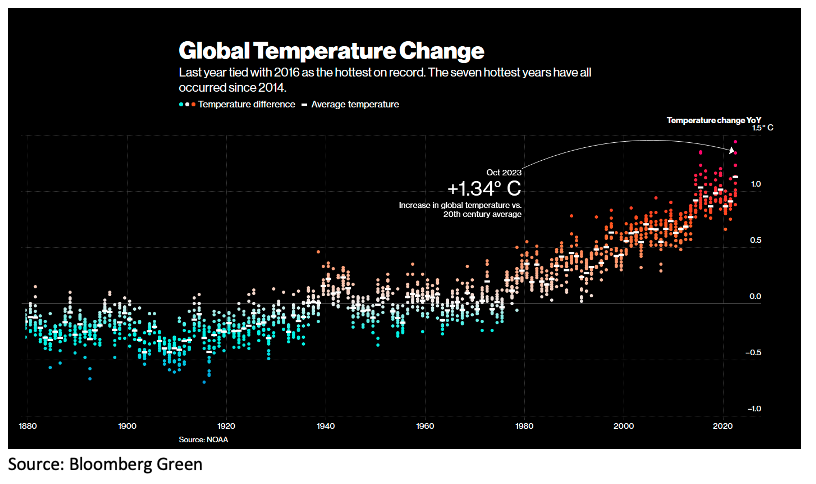

The Climate Crisis

2023 brought a number of extreme weather events including heat waves, floods and wildfires. The summer was the world’s hottest on record. European Union scientists recently said this year is “virtually certain” to be the warmest in 125,000 years. 2024 is expected to bring even more climate volatility, and with it, news coverage. The thing about the weather is that no one knows what will happen and no one controls it. Weather events and changes in global temperatures occur regardless of wars, who is in power, economic booms and busts. How the world – governments, corporations, communities – responds to climate issues will play a role in conflicts, elections and economic growth, not to mention the livelihood of humans.

Learn more about the outlook for 2024 and what trends will be in the spotlight. Read our 2024 Trends series on ICR News & Insights.